10 Chapter 10- Balance Sheets

Balance Sheets

Balance sheets are another valuable financial tool for food and beverage operations. They offer a snapshot of the financial health of these operations at a specific period. They do not track income and expenses over a period like a profit and loss (P&L) statement but rather provide a static picture. They inform the operation about how much cash is on hand, give information regarding the composition of debt and net worth, and give insight into a business’s ability to pay bills.

Balance sheets work best with the other financial statements we cover in this course, such as income statements, operating budgets, and cash flow statements. These analysis tools provide a complete picture of the food & beverage operation’s financial performance.

A balance sheet follows the basic accounting equation: Assets = Liabilities + Owner’s Equity.

This means the total value of everything the business owns (assets) must equal the sum of what it owes (liabilities) and the owner’s investment (equity). Analyzing this equation reveals the business’s net worth.

Balance sheets categorize assets by liquidity (easily convertible to cash within a year) into current and fixed assets (long-term investments like equipment). This breakdown helps assess a business’s ability to meet short-term obligations like paying bills. Inventory levels listed as current assets can be compared to historical data or industry benchmarks. This helps identify potential overstocking or understocking issues impacting cash flow and cost control.

By analyzing the balance sheet, owners can see how much of their money is invested and how much debt the business carries. This information helps with future investment decisions like equipment upgrades or expansion plans.

Balance Sheet Format

For this course, we will use the following balance sheet format. However, most food & beverage operations will have more assets and liabilities on their balance sheets.

Total Assets MUST ALWAYS Equal Total Liabilities and Owner’s Equity.

Balance Sheet Terminology

Asset Terminology

- Cash comes from original investments, bank loans, and cash sales. Money is used to buy inventory, pay bank loans, and pay accounts payable; anytime Cash is used to pay something, its value must be deducted from the cash value.

- Inventory (purchasing of food & beverage inventory), either by Cash or by Credit (Accounts Payable): If you purchase Inventory with Cash, you deduct the purchase amount from Cash; if you are buying with credit, you add the purchase amount to Accounts Payable

- Fixed Assets (furniture, fixtures, glasses, plates, flatware): If you purchase with Cash, the value of the purchase is deducted from the Cash and shows up as fixed assets; if you buy with credit, you add the value to fixed assets and Accounts Payable.

- Total Assets are found by adding up the dollar amounts of cash, inventory, and fixed assets.

Liabilities Terminology

- Accounts Payable are used to purchase items on credit. The amount purchased on credit shows up as an asset (inventory or fixed asset) and as accounts payable. When you pay your accounts payable (credit bill), the amount you pay is deducted from both Cash and accounts payable.

- Notes Payable are bank or installment loans; the amount borrowed shows up in Cash and Notes Payable. When you make a loan payment, the portion you deduct that amount from Cash and reduce the amount of the notes payable.

- Total Liabilities are found by adding up the accounts and notes payable amounts.

- Original Investment is the money the owner(s) have invested in the food & beverage operation, such as the initial Investment to start the business or additional capital contributions.

- Earnings Month to Date (MTD) are the profits shown on the income statement for that month. The MTD amount will be deposited into retained earnings when the month ends.

- Retained Earnings are the accumulated profits of a food & beverage company.

- Total Owners Equity is found by adding up Original Investment, Earnings MTD, and Retained Earnings.

- Total Liabilities and Owner Equity are found by adding Total Liabilities and Total Owners Equity.

Balance Sheet Calculations

Below, you will find the balance sheet transactions for August. Note: the example below represents a start-up business, and there have not been any prior financial transactions

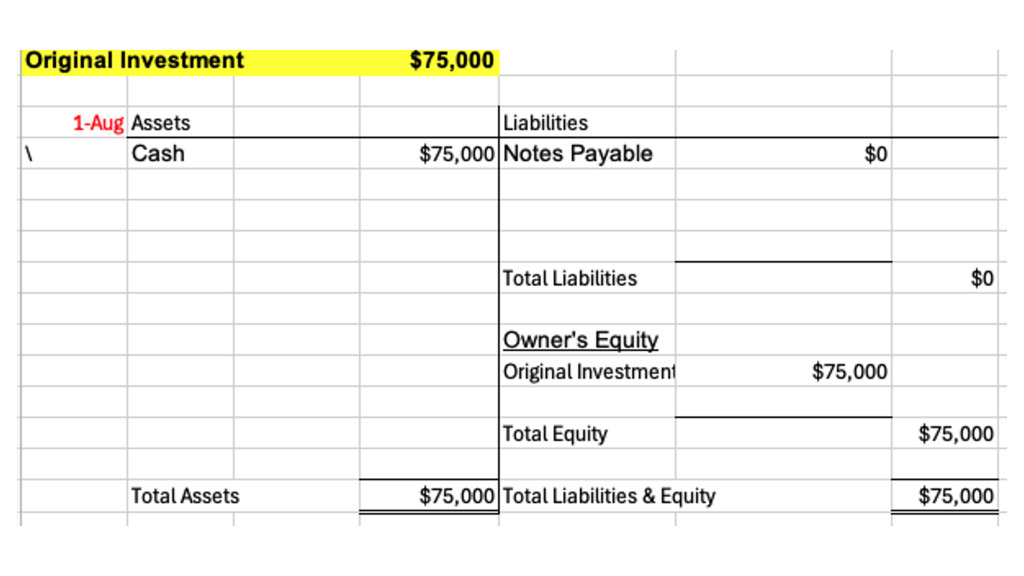

Problem #1 August 1st

- Original Investment- $75,000

The original investment is placed under liabilities original investment and as an asset under cash.

The original investment is placed under liabilities original investment and as an asset under cash.

Both sides balance at $75,000

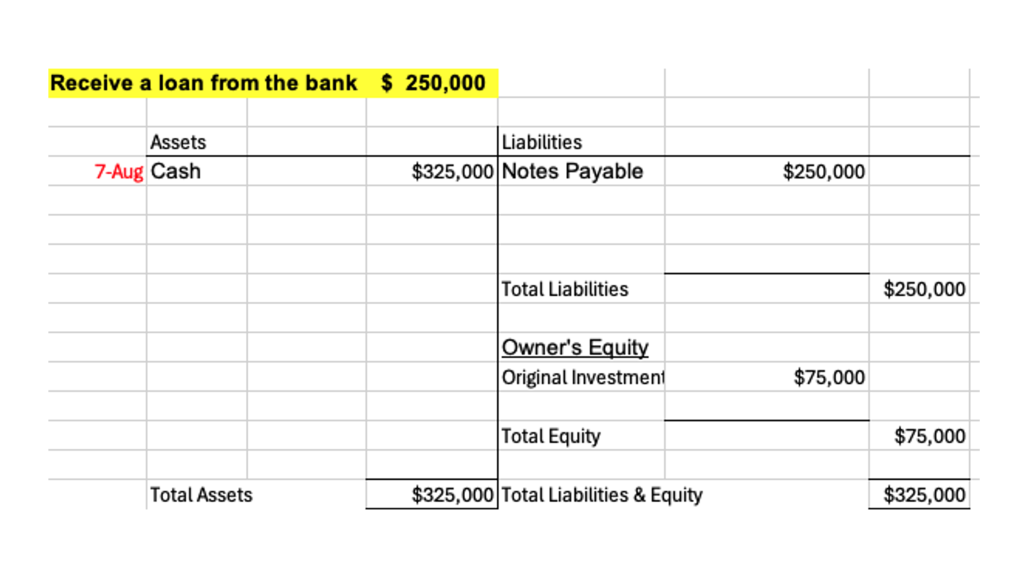

Problem #2 August 7th

- Received a Bank Loan- $250,000

The $250,000 bank loan will show up under notes payable.

The notes payable of $250,000 plus the original investment of $75,000 give you total liabilities and equity of $325,000.

The bank loan is also added to the cash value from the previous problem. ($75,000 +$250,000 = $325,000).

Both sides balance at $325,000

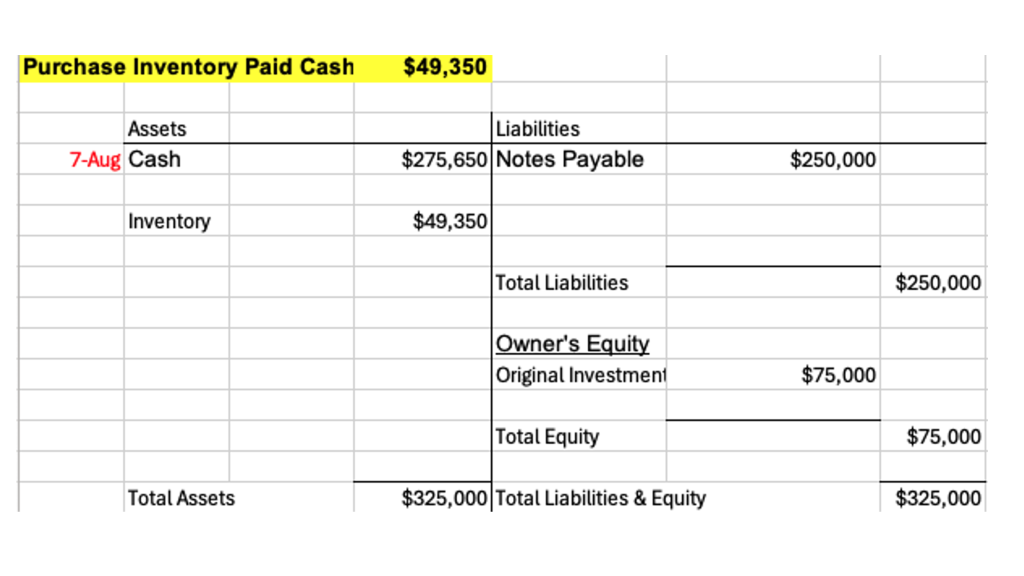

Problem #3 August 7th

- Purchases Inventory Paid Cash- $49,350

We purchased $49,350 of inventory using cash.

We will show the inventory value of $49,350 as an asset under inventory, and because we used cash to purchase the inventory, we must subtract that amount from the previous cash amount (from the last problem) $325,000 – $49,350 = $275,60

Cash of $275,650 + Inventory of $49,350 = $325,000

Note, we did not need to make any calculations on the liabilities side, and we still balance at $325,000

Both sides balance at 325,000

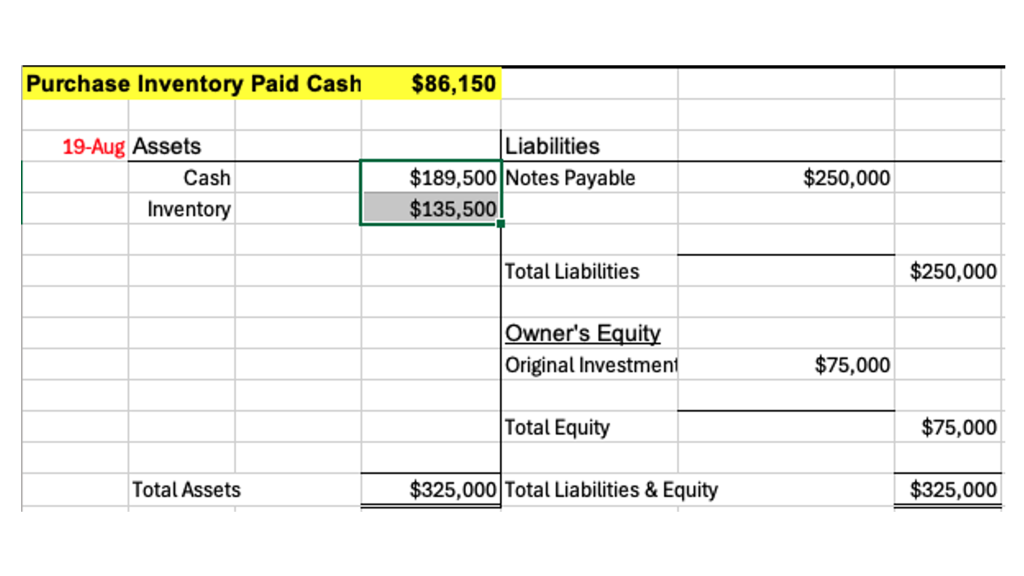

Problem # 4 August 19th

- Purchases Inventory Paid Cash- $86,150

Just like the last calculation, we are buying more inventory using cash.

We purchased an additional $86,150 in inventory. We will add the $86,150 to the previous inventory value of $49,350 to have a new inventory value of $135,500

We also need to subtract $86,150 from the previous cash value of $275,650, bringing our new cash value to $189,500.

Cash of $189,500 + Inventory of $135,000 =$325, 000

Note, we did not need to make any calculations on the liabilities side, and we still balance at $325,000

Both sides balance at 325,000

Problem #5 Preparing the Income Statement August 30

Now, we need to prepare our mini-income statement. Note that you are provided the Cash Sales for August, The Cash Expenses for August, and August closing inventory (they are color-coded)

Step 1:

- We entered the cash sales of $316,875 given to you in the problem.

- We enter the cash expenses of $190,125 that were given to you in the problem.

- We enter the closing inventory of $33,600 given to you in the problem.

- There is no opening inventory because this is a new business, and no previous inventory has been purchased. We enter a zero in the opening inventory.

Step 2:

We entered the inventory value of $135,0000.

- This number comes from two cash inventory purchases from the last two problems. $49,350 + $86,150 = $135,500

Step 3.

- Now that all the boxes are filled, we can calculate the following.

-

- Sales + Purchases = Total Available for Sale

-

- Total Available for Sale – Closing inventory = Cost of Sales

-

- Sales – Cost of Sales = Gross Profit

-

- Gross Profit – Total Expenses = Net Profit

-

-

- NOTE: we will use the net profit of $24,850 in the next problem as earning month-to-date

-

Problem #6 Preparing the End of the Month Balance August 30

Now, we need to finish August by completing the end-of-the-month balance sheet.

Step 1:

- To find the cash value, Take the cash amount of $189,500 from the problem and add it to the cash sales in problem five of $316,875. We then subtract the cash operating expenses of $190,125 to get our cash value for the end of August of $316,250

Note: The same three steps will be used in every balance sheet problem in this course.

Step 2: Using Information from the Mini-Income Statement (Problem 5)

- To find the inventory value:

-

- We use the inventory value from problem five of $33,600

- To find the notes payable value:

-

- We use the notes payable value from problem four of $250,000

- To find the original investment value:

-

- We use the original investment value from problem four of $75,000

- To find earnings month-to-date (MTD):

-

- We use the profit found in problem five of $24,850

We then add up the assets and the liabilities and original owners’ investment to balance on both sides at $349,850

Additional Calculations Not Found in The Example Above

- When we purchase fixed assets using cash, the value of the fixed asset is deducted from the cash, and it shows up under fixed assets.

- When we purchase using credit (we sign the invoice), we use the accounts payable account. Credit purchases do not impact the balance sheet cash value until we pay for them, just like using your credit card and then paying your credit card bill. Food & beverage businesses typically purchase inventory and fixed assets on credit if they have established credit with vendors.

- We deduct the amount being paid on accounts payable from the accounts payable total. Because we will be using cash to make the payment, we deduct the accounts payable amount from the cash value.

- When we pay for our bank loan (notes payable), we deduct the amount paid from the total notes payable account. Because we will use cash to make the payment, we also deduct the notes payable amount from the cash value.

An Example of a Restaurant Balance Sheet with Additional Categories

Media Attributions

- Balance 1

- Balance 3

- Balance 4

- Balance 5

- Balance 6

- Screenshot 2024-08-01 at 2.53.18 PM

- Screenshot 2024-08-01 at 3.01.27 PM

- Screenshot 2024-08-01 at 3.11.17 PM

- Screenshot 2024-08-01 at 3.13.57 PM

- Screenshot 2024-08-01 at 3.26.48 PM

- Screenshot 2024-08-01 at 3.31.52 PM