7 Chapter 7- Monthly Cost of Sales

Monthly Cost of Sales

In this chapter, we distinguish between the cost of food sold and the cost of food consumed. We take for granted all the free or discounted meals we eat when working at food & beverage establishments, but those meals cost the operator money. The government allows operators to deduct the cost of employee meals. But more importantly, the cost of those meals, with little or no revenue received, can dramatically affect food costs. In this chapter, we will explore various techniques for assigning the actual cost of those meals and other additions and subtractions to the monthly cost of sales, such as transfers, promotions, gratis, and steward sales.

Cost of Food Sold (COGS):

- Focuses on the direct cost of ingredients used in items sold to customers.

- Represents the value of inventory that is depleted through production and sales.

- Calculating both the food cost percentage and the beverage cost percentage, which are key performance metrics for F&B businesses, is crucial.

Cost of Food Consumed:

- Takes a broader view, encompassing all food and ingredient costs within a specific period.

-

- Includes not only ingredients used for sales but also:

- Food wasted due to spoilage or preparation errors.

- Employee meals, promotions, food products for promotional purposes, charity events, wedding promotion shows, comped meals, gratis, and steward sales

- Includes not only ingredients used for sales but also:

-

Why the difference matters:

- COGS directly impacts your profitability from sales.

- The cost of food consumed helps you understand overall food usage and identify areas for potential cost savings (e.g., reducing waste).

Employee Meals

A food & beverage business can deduct employee meals provided for free in a cafeteria (or other designated area) during work hours under specific conditions set by the IRS. Here is how it works:

The “De Minimis Fringe” Benefit:

The IRS allows businesses to deduct the cost of these meals as a “de minimis fringe” benefit, meaning that the benefit is so small and infrequent that it is not considered taxable income for the employee or a significant expense for the company. The meals themselves should be considered a small benefit. There is no strict dollar limit, but the overall cost needs to be reasonable.

Here are the critical requirements for this deduction:

- Convenience of the Employer: The meals must be primarily for the employer’s benefit, not the employees. They should be offered during work hours, making it easier for employees to stay on-site and productive.

- More Than Half Rul states that if the cafeteria serves more than half of the employees on a non-discriminatory basis (meaning all employees have access regardless of position), all meals provided there are considered for the employer’s convenience.

Employee Benefits Deduction Considerations:

- Tax-Free for Employees: Free meals that meet these criteria are not considered taxable income for the employees.

Recordkeeping

- While no recordkeeping requirement exists for de minimis fringes, tracking costs for tax purposes is a good practice.

- Highly Compensated Employees: For highly compensated employees (as defined by the IRS), there is an additional test to ensure the meals are available to everyone equally.

Alternatives and Considerations:

- Meal Stipend Programs: Some companies offer a fixed amount of money per meal as part of a meal stipend program. This will allow for more flexibility but still provide some cost control (potentially less deductible for the company).

- Track Overall Costs: You can track the total cost of a meal program without examining individual meal details, simplifying record keeping. However, this does not offer a full tax benefit.

The Four Methods to Determine the Cost of Employee Meals

Food and beverage businesses use four methods to calculate the cost of employee meals. Once an operation determines the dollar amount of feeding employees, it can subtract that amount from the food cost and put it into the employee benefits expense of the labor cost component of the income statement. When a business provides meals to its employees, the price of the meals is an employee benefit.

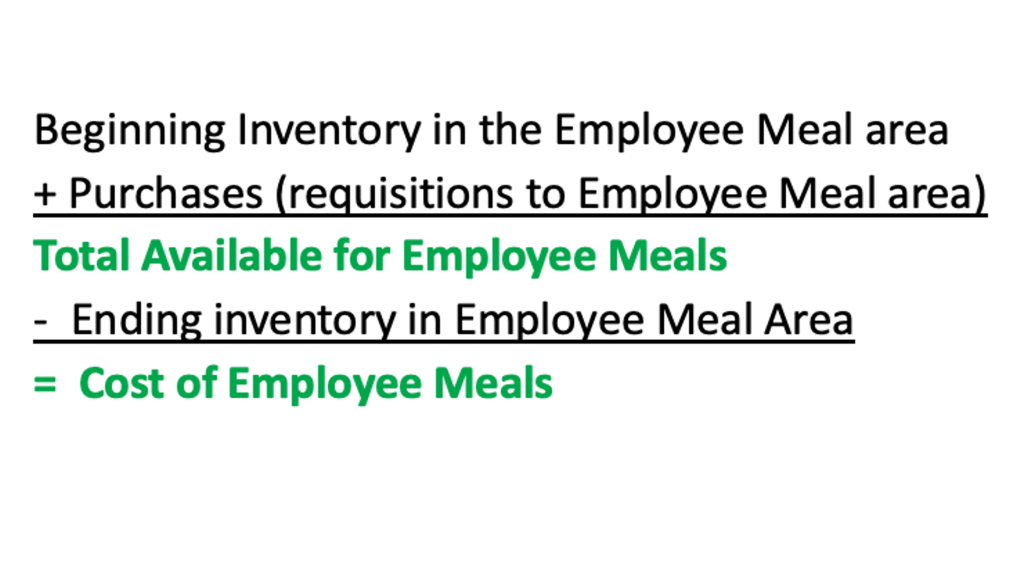

1.) The Cost of Separate Issues

Separate issues are food requisitioned from the storeroom. This method works well when a food and beverage operation has an employee cafeteria, as you might find in a large hotel or resort. When the kitchen requisitions food from the storeroom, the food is treated like a purchase.

The employee cafeteria kitchen area takes all the food it started with (beginning inventory)plus everything it requisitioned to feed employees, minus whatever was left for employee meals at the end of the month (Ending Inventory).

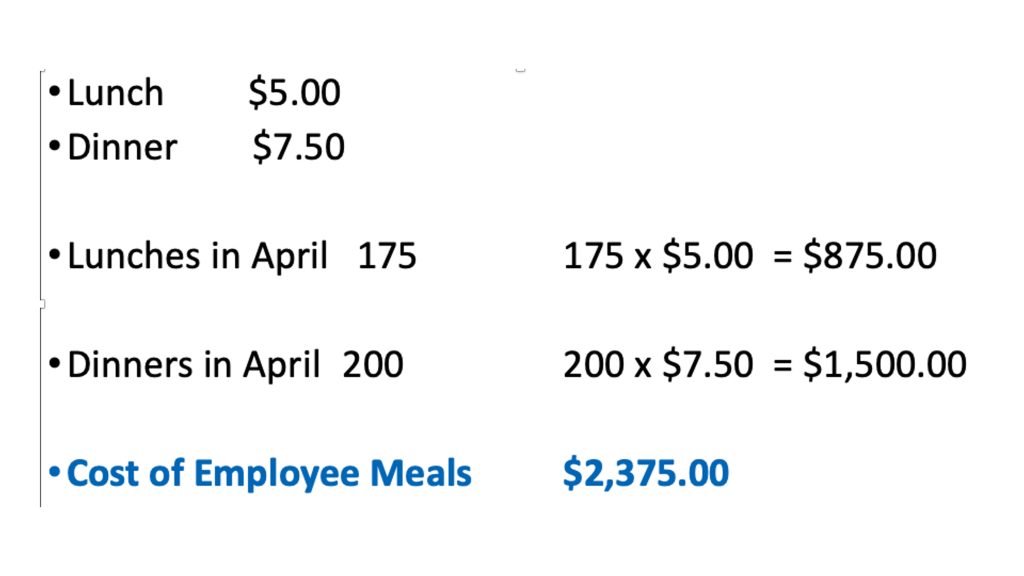

2 A.) The Prescribed Amount Per Meal

With the prescribed amount per meal method, the kitchen is allowed a specific dollar amount to feed employees per meal. For example, if the amount permitted for breakfast was $2.50, lunch was $5.00, and dinner was $7.50, the cost of the meals provided to employees would fit within the budgetary guidelines. For this method, a manager or chef must also count how many employees ate per meal period. The cost of the employee meals is not necessarily cost out, and the food served to employees often involves excess food products, overproduction, and utilizing food products before they spoil.

$2,375.00 would be deducted from food costs and charged to employee benefit expenses.

2 B.) The Prescribed Amount Per Period

The prescribed amount per period method is when a food & beverage operation assigns a dollar amount to employee meals. For example, if the prescribed amount for the month is $1,000.00, that is the dollar amount credited to food costs and added to employee benefits expenses for the month. The number of employees who ate an employee meal and the cost of the employee meals are not tracked. Thus, if this method is used, the chef/manager must monitor what employees eat to ensure that the monthly costs do not exceed $1,000.00 of employee meals.

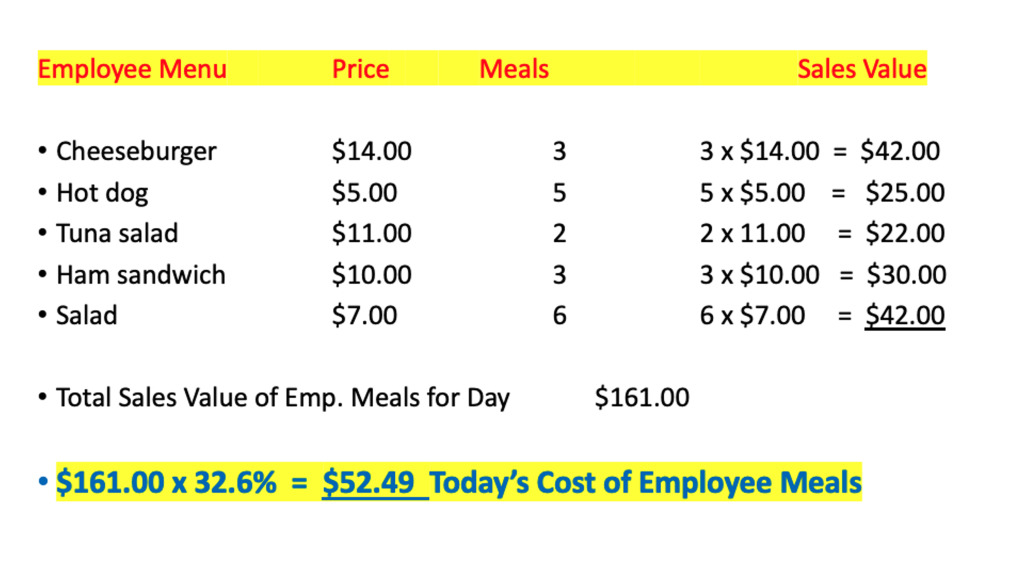

3.) The Sales Value Multiplied by a Designated Food Cost Percentage

For the sales value multiplied by the cost method, employees select employee meals predetermined by management from the menu, and the employee meals get recorded at the menu selling price value, typically by entering the employee meals into an employee meals section on the point-of-sale system or recorded manually on a dupe slip. However, the menu selling price of the employee meals does not go into sales but is tracked for the period (day, week, month) and then multiplied by a set food cost percentage assigned by management. The food & beverage businesses frequently use the standard food cost to establish the actual food cost percentage from the previous or current month for this method.

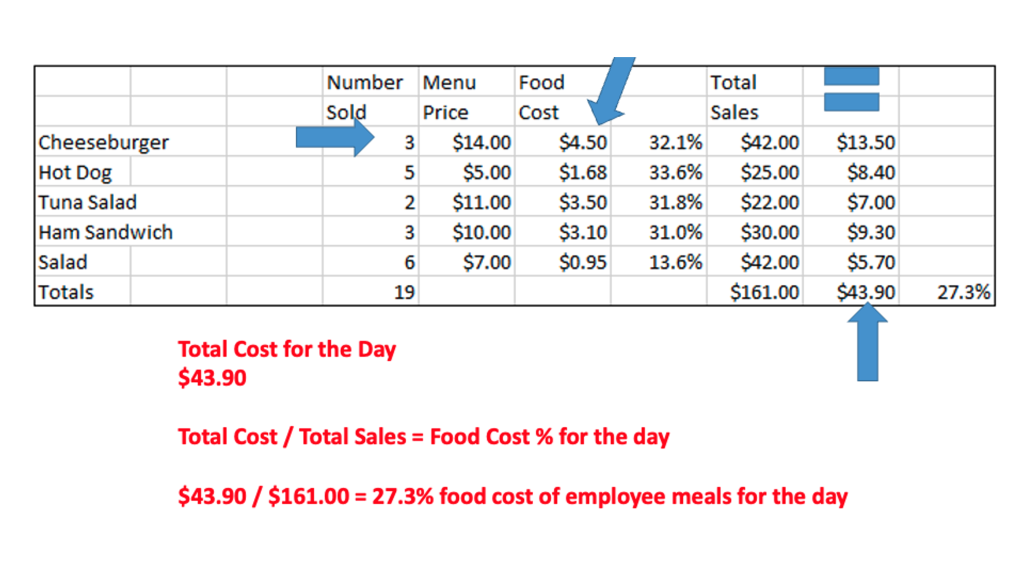

4.) The Sales Value Multiplied by the Actual Food Cost Percentage

The sales value is multiplied by the actual food cost percentage method. The employees are still eating meals from an employee meal menu, which is accounted for by being entered into a point-of-sales system or tracked manually. But instead of using an arbitrarily assigned food cost percentage for this method, we use the actual food cost of each employee meal menu item.

Transferring Food and Beverage Products (Transferring Inventory)

It is common, especially in more extensive food & beverage operations, to transfer products from one department or cost center to another. For instance, the cost of food items such as lemons and limes used to make alcoholic drinks are transferred out of the food inventory (food cost) and transferred to the bar inventory (beverage cost) to produce beverages that generate beverage sales. When the kitchen uses alcohol to create menu items to generate food sales, the cost of the alcohol is transferred from beverage inventory (beverage cost) to food inventory (food cost).

Gratis to the bar is another transfer from food inventory (food cost) to beverage inventory (beverage cost). Gratis to the bar are those food items such as salty snacks or complimentary appetizers provided to bar patrons to help generate beverage sales. The food cost was transferred to the beverage department since these items were not used to create food sales but instead beverage sales.

Transfers also take place for promotional events. If this month a food and beverage operation donated $2000 of food to a charity fundraiser, or if the business participated in a wedding promotion where they provided food samples for free to the participants of the show, we used $2,000 worth of food for marketing purposes, and not food sales. The cost of all this food is transferred from food cost and goes into marketing, marketing, and promotions on the income statement.

Calculating the Cost of Food Consumed

Now that we know how to deduct employee meals and transfers, we will no longer determine the cost of food sold by using this equation:

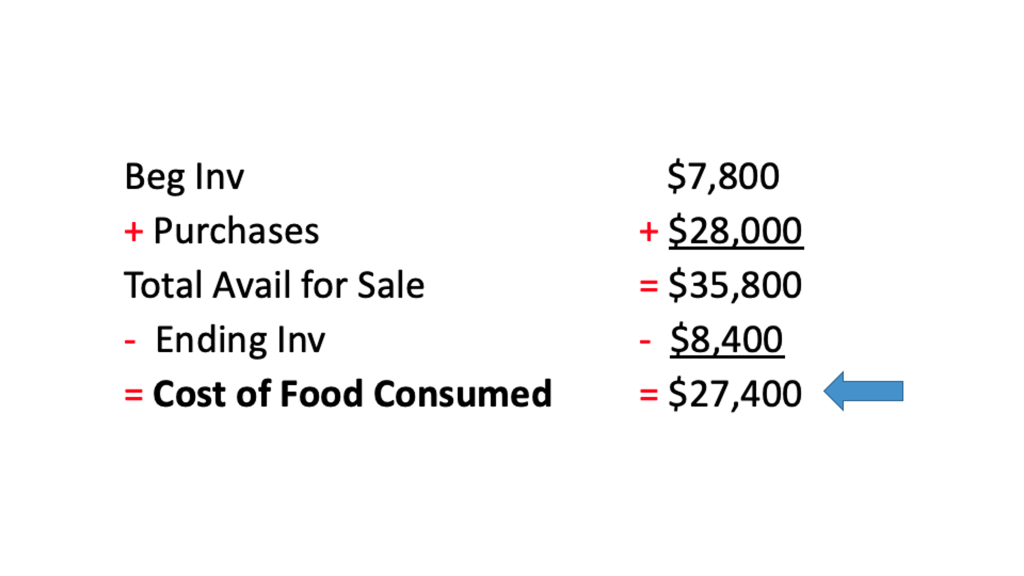

Beginning Inventory + Purchases – Ending Inventory = Food Cost or Cost of Goods Sold.

Now, we will call it the Cost of Food Consumed. and use the equation below.

Calculating actual Food or Beverage Costs

Calculating actual Food or Beverage Costs, including employee meals and transfers from one department or account to another.

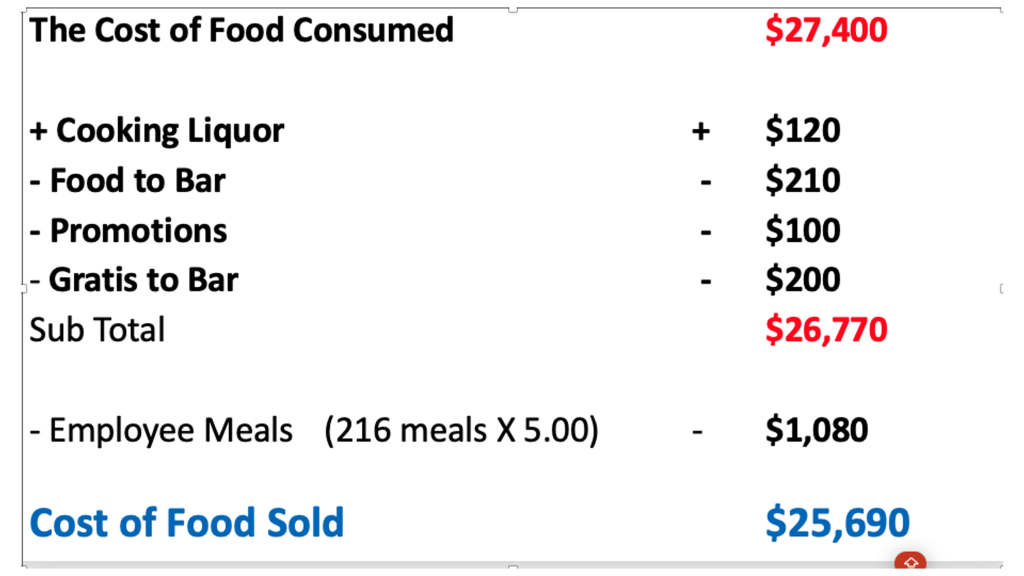

Now that we have calculated the cost of food consumed at $27,400, we would add all the transfers for cooking liquor and deduct the transfers plus the cost of employee meals.

During the month, we had $120 transferred from beverage cost to food cost for cooking liquor, and the bar transferred $210 for lemons/limes and other food products used to make alcoholic drinks. We donated $100 worth of food to a promotional event and $200 gratis to the beverage department used to generate beverage sales. We would adjust the cost of food consumed as follows:

Our cost of food sold for the month is $25,690. Hypothetically, say our food sales for the month were $78,000

Without adjustments, our food cost would have been $27,400 / $78,000 = 35.1%.

However, because we were able to make the adjustments above to our food costs, our current cost of food sold is $25,690.

Thus, our food cost is $25,690 / $78,000 = 32.9%, a difference in the food cost percentage of over two percent.

Media Attributions

- Monthly COGS 1

- Monthly COGS 2

- Monthly COGS 3

- Monthly COGS 4

- Monthly COGS 5

- Monthly COGS 6