33

The travel services sector helps travellers arrange and reserve their vacation or business trips (StatsCan, 2018). This sector is made up of businesses and organizations that work in a coordinated effort to provide travellers with seamless arrangements to maximize their travel experience. Go2HR describes travel services experiences and employment opportunities as follows:

Within this sector, you have the flexibility of working in various capacities with event and conference planning organizations, travel companies and organizations, as well as associations, government agencies and companies that specialize in serving the needs of the tourism sector as a whole. (go2HR, Essential Tips – Travel Services, 2020)

Before we move on, let’s explore the term travel services a little more. As detailed in Chapter 1, Canada, the United States, and Mexico have used the NAICS guidelines, which define the tourism industry as consisting of transportation, accommodation, food and beverage, recreation and entertainment, and travel services (Tourism HR Canada, 2020). These five sectors are defined and further detailed in B.C. by the B.C. government (BC Government, 2014) and go2HR on their website (go2HR, Career Explorer, 2020).

For many years, however, the tourism industry was classified into eight sectors: accommodations, adventure and recreation, attractions, events and conferences, food and beverage, tourism services, transportation, and travel trade (Yukon Department of Tourism and Culture, 2020; go2HR, 2020, What is Tourism? – Travel Services).

Tourism services support industry development and the delivery of guest experiences, and some of these are missing from the NAICS classification. To ensure you have a complete picture of the tourism industry in BC, this chapter will cover both the NAICS travel services activities and some additional tourism services.

First, we’ll review the components of travel services as identified under NAICS, as well as exploring popular careers within:

- Travel agencies (brick and mortar)

- Online Travel Agencies/OTA

- Tour operators

- Destination marketing organizations (DMOs)

- Other Organizations

Following these definitions and descriptions, we’ll take a look at some other support functions that fall under tourism services. These include sector organizations, tourism and hospitality human resources organizations, training providers, educational institutions, government branches and ministries, economic development and city planning offices, and consultants.

Finally, we’ll look at issues and trends in travel services, both at home, and abroad.

While the application of travel services functions are structured somewhat differently around the world, there are a few core types of travel services in every destination. Essentially, travel services are those processes used by guests to book components of their trip. Let’s explore these services in more detail.

Travel Agencies

A travel agency is a business that operates as the intermediary between the travel industry (supplier) and the traveller (purchaser). Part of the role of the travel agency is to market prepackaged travel tours and holidays to potential travellers. The agency can further function as a broker between the traveller and hotels, car rentals, and tour companies (Goeldner & Ritchie, 2003). Travel agencies can be small and privately owned or part of a larger entity.

A travel agent is the direct point of contact for a traveller who is researching and intending to purchase packages and experiences through an agency. Travel agents can specialize in certain types of travel including specific destinations; outdoor adventures; and backpacking, rail, cruise, cycling, or culinary tours, to name a few. These specializations can help travellers when they require advice about their trips. Some travel agents operate at a fixed address and others offer services both online and at a bricks-and-mortar location. Travellers are then able to have face-to-face conversations with their agents and also reach them by phone or by email. To promote professionalism within the travel industry, travel counsellors can apply for a specialized diploma or certificate in travel from ACTA (ACTA, 2020a; go2HR, 2020a).

Today, travellers have the option of researching and booking everything they need online without the help of a travel agent. As technology and the internet are increasingly being used to market destinations, people can now choose to book tours with a particular agency or agent, or they can be identified as seeking Domestic Independent Travel (DIT) or Foreign Independent Travel (FIT), by creating their own itineraries from a number of suppliers.

Online Travel Agents (OTAs)

Increasing numbers of travellers are turning to online travel agents (OTAs), companies that aggregate accommodations and transportation options and allow users to choose one or many components of their trip based on price or other incentives. Examples of OTAs include iTravel2000, Booking.com, Expedia.ca, Hotwire.com, and Kayak.com. OTAs continue to gain popularity with the travelers; in 2012, they reported online sales of almost $100 billion (Carey, Kang, & Zea, 2012) and almost triple that figure, upward of $278 billion, in 2013 (The Economist, 2014).

In early 2015 Expedia purchased Travelocity for $280 million, merging two of the world’s largest travel websites. Expedia became the owner of Hotels.com, Hotwire, Egencia, and Travelocity brands, facing its major competition from Priceline (Alba, 2015).

Although OTAs can provide lower-cost travel options to travellers and the freedom to plan and reserve when they choose, they have posed challenges for the tourism industry and travel services infrastructure. As evidenced by the merger of Expedia and Travelocity, the majority of popular OTA sites are owned by just a few companies, causing some concern over lack of competition between brands. Additionally, many OTAs charge accommodation providers and operators a commission to be listed in their inventory system. Commission-based services, as applied by Kayak, Expedia, Hotwire, Hotels.com, and others, can have an impact on smaller operators who cannot afford to pay commissions for multiple online inventories (Carey, Kang & Zea, 2012). Being excluded from listings can decrease the marketing reach of the product to potential travellers, which is a challenge when many service providers in the tourism industry are small or medium-sized businesses with budgets to match.

While the industry and communities struggle to keep up with the changing dynamics of travel sales, travellers are adapting to this new world order. One of these adaptations is the ever-increasing use of mobile devices for travel booking. The Expedia Future of Travel Report found that 49% of travellers from the millennial generation (which includes those born between 1980 and 1999) use mobile devices to book travel (Expedia Inc., 2014), and these numbers are expected to continue to increase. Travel agencies are reacting by developing personalized features for digital travellers and mobile user platforms (ETC Digital, 2014). With the number of smartphone users expected to reach 1.75 billion in 2014 (CWT Travel Management Institute, 2014) these agencies must adapt as demand dictates.

A key feature of travel agencies’ (and to a growing extent transportation carriers) mobile services includes the ability to have up-to-date itinerary changes and information sent directly to consumers’ phones (Amadeus, 2014). By using mobile platforms that can develop customized, up-to-date travel itineraries for clients, agencies and operators are able to provide a personal touch, ideally increasing customer satisfaction rates.

Take a Closer Look: PATA — The Future of Travel is Personalisation at Scale

“The industry has changed monumentally over the past decade. The rise of meta-search websites and sharing economy services like Airbnb is giving travellers more control and choice than ever before. However, this is nothing compared to the changes that are on the horizon as technologies like mobile, AR, AI, and VR become mainstream.

One thing is certain; the pace of change is accelerating. Against this backdrop, the travel industry as a whole will need to fundamentally shift its focus to continuous innovation.” (PATA, 2019)

Despite the growth and demand for OTAs, brick and mortar travel agencies are still in demand by travellers (IBISWorld, 2019) as they have both an online presence and physical locations. The COVID-19 pandemic may see an increase in travellers relying on personal contact with brick and mortar travel agencies but at a distance through mail and phone.

Tour Operators

A tour operator packages all or most of the components of an offered trip and then sells them to the traveller. These packages can also be sold through retail outlets or travel agencies (CATO, 2020; Goeldner & Ritchie, 2003). Tour operators work closely with hotels, transportation providers, and attractions in order to purchase large volumes of each component and package these at a better rate than the traveller could if purchasing individually. Tour operators generally sell to the leisure market.

Inbound, Outbound, and Receptive Tour Operators

Tour operators may be inbound, outbound, or receptive:

- Inbound tour operators bring travellers into a country as a group or through individual tour packages (e.g., a package from China to visit Canada).

- Outbound tour operators work within a country to take travellers to other countries (e.g., a package from Canada to the United Kingdom).

- Receptive tour operators (RTOs) are not travel agents, and they do not operate the tours. They represent the various products of tourism suppliers to tour operators in other markets in a business-to-business (B2B) relationship. Receptive tour operators are key to selling packages to overseas markets (Destination BC, 2020) and creating awareness around possible product.

Destination Marketing Organizations

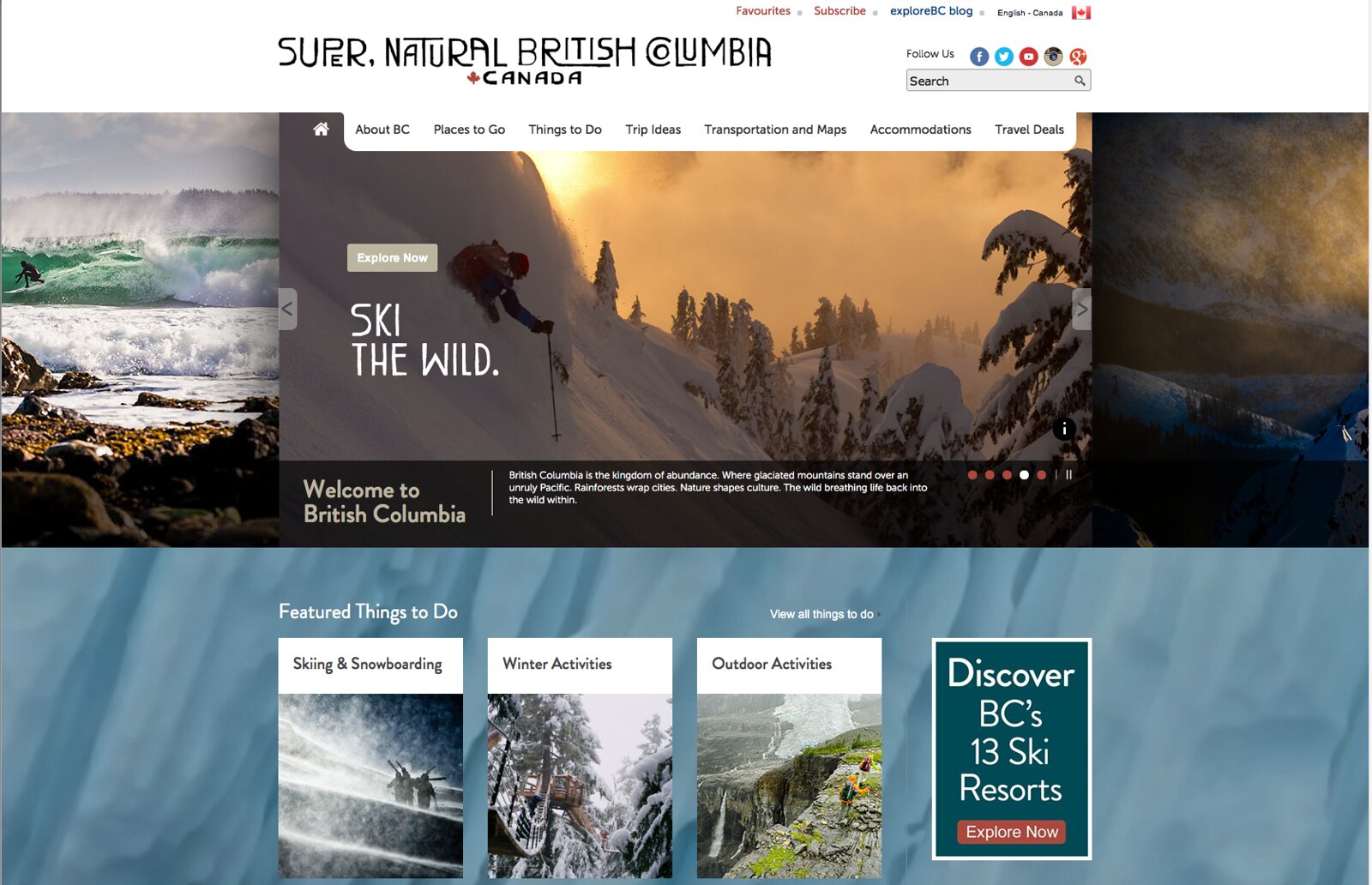

Destination marketing organizations (DMOs) include national tourism boards, state/provincial tourism offices, and community convention and visitor bureaus around the world. DMOs promote “the long-term development and marketing of a destination, focusing on convention sales, tourism marketing and service” (Destinations BC, 2020).

Spotlight On: Destinations International

Destinations International is the global trade association for official DMOs. It is made up of over 600 official DMOs in 15 countries around the world. DMAI provides its members with information, resources, research, networking opportunities, professional development, and certification programs. For more information, visit the Destinations International website.

With the proliferation of other planning and booking channels, including OTAs, today’s DMOs are shifting away from travel services functions and placing a higher priority on destination management components.

Working Together

One way tour operators, DMOs, and travel agents work together is by participating in familiarization tours (FAMs for short). These are usually hosted by the local DMO and include visits to different tour operators within a region. FAM attendees can be media, travel agents, RTO representatives, and tour operator representatives. FAMs are frequently low to no cost for the guests as the purpose is to orient them to the tour product or experience so they can promote or sell it to potential guests.

Other Organizations

The majority of examples in this chapter so far have pertained to leisure travellers. There are, however, specialty organizations that deal specifically with business trips.

Spotlight On: Global Business Travel Association (GBTA) Canada

“GBTA Canada is the voice of the Canadian business travel industry. We believe in providing the business travel and meetings community with a global platform to serve as a resource library for their peers, to implement world-class Conferences, workshops and virtual meetings, and to foster an interactive network of innovation and support.” The GBTA state that their economic impact contributes $23.5 billion CAD in Canadian business travel (Economic Impact Study) and “$435+ billion CAD of business travel and meetings expenditures represented globally.” Visit the GBTA website.

Business Travel Planning and Reservations

Unlike leisure trips, which are generally planned and booked by end consumers using their choice of tools, business travel often involves a travel management company, or its online tools. Travel managers negotiate with suppliers and ensure that all the trip components are cost effective and comply with the policies of the organization.

Many business travel planners rely on global distribution systems (GDS) to price and plan components. GDS combine information from a group of suppliers, such as airlines. In the past, this has created a chain of information from the supplier to GDS to the travel management company. Today, however, there is a push from airlines (through the International Air Transport Association’s Resolution 787) to dissolve the GDS model and forge direct relationships with buyers (BTN Group, 2014).

Destination Management Companies

According to the Association of Destination Management Executives International (ADMEI), a destination management company (DMC) specializes in designing and implementing corporate programs, and “is a strategic partner to provide creative local experiences in event management, tours/activities, transportation, entertainment, and program logistics” (ADMEI, 2020). The packages produced by DMCs are extraordinary experiences rather than general business trips. These are typically used as employee incentives, corporate retreats, product launches, and loyalty programs. DMCs are the one point of contact for the client corporation, arranging for airfare, airport transfers, ground transportation, meals, special activities, and special touches such as branded signage, gifts, and decor (ADMEI, 2020). The end user is simply given (or awarded) the package and then liaises with the DMC to ensure particular arrangements meet his or her needs and schedule.

As you can see, travel services range from online to personal, and from leisure to business applications. Now that you have a general sense of the components of travel services, let’s look at some examples in Canada and BC.